Mobile money transactions to hit Ghs 1 trillion in value by 2022 – Ken Ofori-Atta, Dr Bawumia

Minister for Finance, Ken Ofori-Atta, has said mobile money transactions in the country is expected to hit a total of Ghs 1 trillion in value by next year.

The projected growth in mobile money transactions by the Finance Minister, comes on the back of the surge in the value of mobile money transactions by more than Ghs 500 billion in the last five years.

The value of mobile money transactions as measured by the mobile money interoperability platform implemented by government, increased from Ghs 35 billion in 2015 to Ghs 570 billion in 2020.

“Ghana saw an increase of Ghs 400 billion in mobile money transactions last year and possibly this could increase to a trillion cedis next year,” remarked the Finance Minister at Standard Chartered’s Digital Banking, Innovation and Fintech Festival.

Affirming the Finance Minister’s projection was the Vice President Dr Bawumia who noted, “When you look at the way Mobile Money Interoperability was executed, we got everybody in this ecosystem on the same platform. Before, you had everybody working in different silos. You couldn’t even get moving money from MTN to say Vodafone. That couldn’t even happen.

“But once we brought everybody on one platform you now have interoperability, which is actually expanding the pie for everybody. We had Ghs35 billion worth of mobile money transactions in 2015; last year it was Ghs570 billion after we have done mobile money interoperability, and next year, we are looking towards a Trillion Ghana cedis of mobile money transactions.”

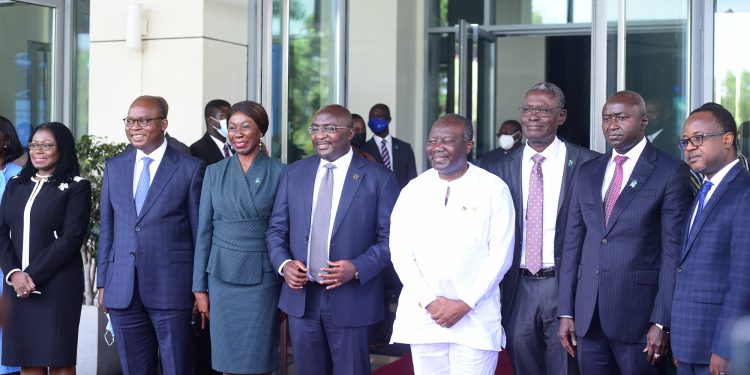

Delivering the Keynote address at the event, Dr Bawumia called on the various stakeholders in the financial sector to collaborate and work together to enable synergies that will help them and citizens reap the full benefits of government’s digitization agenda.

According to the Vice President, government on its part remains committed to the policy of building a digital economy, a financial ecosystem, and a system that best delivers a more efficient, transparent, inclusive building block in public administration.

Speaking on the theme, “Enabling the Digital Economy for the 21st Century,” the Vice President challenged stakeholders in the financial sector to continue to innovate whilst collaborating, emphasising that it is still possible to collaborate and compete at the same time.

“Investments in Innovation is crucial. Banks, financial institutions and other stakeholders should invest in digitalisation and innovation. It is the way to go. Just like client service, innovation must be at the very heart of our businesses. It will have impact on new products we churn out, make our customers more satisfied and increase value to stakeholders when done right.

“Collaboration will cement the ecosystem further. The digital economy thrives on information and collaboration. Banks, fintechs, telecom companies, governments, regulators and consumers should form one big bloc sharing information and feedback that loops everyone. Collaboration will provide opportunities for entities with different specialisations to work together to achieve bigger goals.

“Fundamentally, there is no inconsistency between competition and collaboration. I know that many of the stakeholders in our ecosystem, the private sector are very profit-driven. The Central Bank has to guard, jealously, the safety and stability of the system, and strive to get financial inclusion.

“But if we don’t collaborate, then everybody would be in silos, but once we come together in one ecosystem, then we are able to derive economies of scale from that collaboration, where the whole is greater than the sum of the parts. We are very focused on inclusion, and this is why it is very important, that as we build these systems, we try to bring everybody on a common platform.

Concluding his remarks at the event, the Vice President congratulated the board, management and staff of Standard Chartered for the celebration of the banks’ 125 years of operation in Ghana.

“Indeed, the chronicle of Ghana’s economic history would not be complete without mentioning Standard Chartered as a result of the significant contribution to almost every facet of the economy. You have put your capital behind opportunities such as providing long term financing for infrastructure development, providing sovereign solutions and more recently providing financing for the Sustainable Development Goals,” the Vice President stated.

The Digital Banking, Innovation and Fintech Festival forms part of the activities of the bank’s 125th-anniversary celebrations in Ghana and an apt platform to showcase Ghana’s digital infrastructure and the great strides the country has made in its national digitalisation journey.

The Digital Banking, Innovation and Fintech Festival FinTech festival under the theme, “Shaping the next phase of Ghana’s Financial Technology Landscape for the 21st Century”, brings together local and international players in the Fintech ecosystem, seasoned experts and practising Fintech innovators to engage and share insights on how to adopt, leverage and scale digitisation, innovation and technology within the financial sector.