Nigeria’s Central Bank raises monetary policy rate to 13%, the first time in 6 years

The Monetary Policy Committee of the Central Bank of Nigeria has voted unanimously to raise the benchmark interest rate to 13% after two years of expansionary monetary policy.

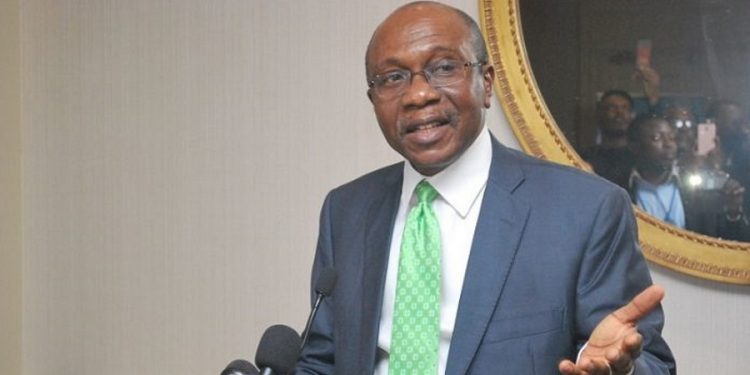

This was disclosed by the Governor of the CBN, Godwin Emefiele, while reading the communique of the third monetary policy committee meeting of the year, on Tuesday 24th May 2022.

The rate which had been at 11.5% since September 2020, in a bid to spur recovery from the recession recorded due to the covid-19 has now been raised by the apex bank after the inflation rate rose above 16%.

CBN’s hawkish move is targeted at curbing the rising rate of inflation in the country, while still cautiously ensuring economic growth. This is also a massive reversal from CBN’s earlier stand that raising rates will not positively impact inflation.

“MPC also feels that not only would tightening reverse the steady improvement recorded in credit expansion, it is also of the view that tightening would not necessarily tame the inflation, particularly where the marginal decline is relatively not yet sustainable”

Highlights of the Committee’s decision

- MPR raised to 13%

- The asymmetric corridor of +100/-700 basis points around the MPR was retained

- CRR was retained at 27.5%

- While Liquidity Ratio was also kept at 30%

Rate Change History

The latest hike in rates by the central bank’s monetary policy committee is the first since July 2016 as the apex bank preferred lower interest rates hoping it will spur lending.

- However, with inflation rising globally, the apex bank has joined the global trend of increasing interest rates to combat a sticky rising cost of goods in services.

- But unlike in global economies, Nigeria’s rising inflation is more supply-driven than demand thus leading pundits to believe CBN policies have little to no effect.

- The last time the central bank raised rates were in July 2016 when rates moved from 12% to 14% and remained that way until March 2019 when they dropped to 13.5% signaling the CBN’s plan to stop its juicy OMO sales

- Since then, interest rates dropped to 12.5% in May 2020 in response to Covid-19 and on September 11.5% which it has remained until the latest change it rates

Is the CBN sending a Signal?

The change in rates suggests the apex bank has finally accepted the impact of inflation on its monetary policies. Before now, it has preferred a policy that forced the government to look towards addressing supply bottlenecks, while believing lower interest rates could help spur lending and thus increase economic growth.

“While growth has continued to improve, members noted that inflation was confronted with upward pressure due to emerging risks within the domestic and external environment. The MPC, however, noted that the substantial upward push to price levels continued to be influenced by supply-side factors such as the scarcity of PMS, persisting insecurity and backlash from the Russia-Ukraine war. These require a careful and focused policy intervention to address and resolve. In this light, the MPC, urged the Bank to continue using the tools at its disposal, while increasing its collaboration with the fiscal authority to ensure that inflation is adequately reined in and growth is returned to a strong and sustainable path.”