Poor implementation of e-levy to erode gains made in financial services sector – Telecoms Chamber

The Ghana Chamber of Telecommunication has warned that gains made in the financial services sector could be eroded if the expected implementation of the electronic transaction levy is not properly carried out.

The Chamber, is at the same time cautioning against revenue losses from taxes as a result of the collapse of some third party firms within the financial technologies space.

Ghana is one of the fastest growing mobile money market in Africa and it is presently the market leader in West Africa.

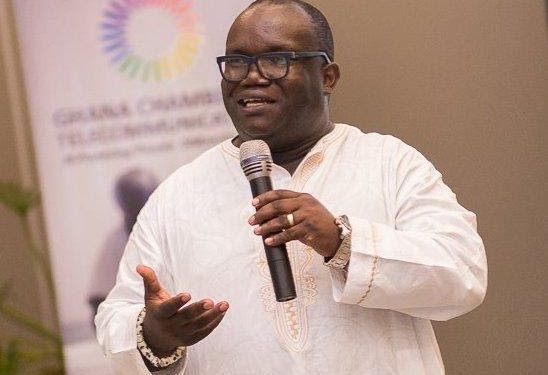

Speaking at the 2022 Ghana Economic outlook organized by the Ghana-German Economic Association, Chief Executive of the Chamber, Ken Ashigbey, called for broader consultation on the e-levy before implementation.

“My presentation for this part is to look at some of these unintended consequences and some of the proposals that we made. Some of them have been taken, some of them have not been taken yet, but we are hopeful that with the engagement that is going to happen with all of us, we will be able to ensure that we can shape this policy so that the unintended consequences don’t happen.

“And I’ve heard the Deputy Minister for Finance talk about a reversal drop of about 24%. If you look at the data from other markets, they have not been that lucky, they have done worse than 24% and we need to ensure that we don’t erode our national digitization agenda, our national financial inclusion agenda is not impacted negatively, our job creation that we seek to push is not badly affected and so on,” he said.

Meanwhile, Senior Law Lecturer at the University of Ghana, Dr Ali-Nakyea, has averred the implementation of the electronic transaction levy (E-Levy) may have some direct and indirect unintended consequences on the economy.

Read: Mali defaults on $31 million bond payments

Making the assertion during a presentation on the E-Levy in Accra, the tax expert noted the E-Levy aside having a negative impact on the country’s financial inclusion drive, will among others result in the unnecessary reduction in disposable incomes of Ghanaians.

According to him, taxing mobile money is in real effect going to reduce the amount of money available to cater for basic needs like health and education.

Adding that the tax will increase the cost of sending and receiving money which will negatively affect value chains in agriculture, access to energy, utilities and trade services.

“In effect, we could lose out at both consumer and institutional levels,” he further remarked.

Also to be an indirect unintended consequence on the economy will be the risk of promoting money laundering as the levy could drive users off the mobile money platform and resort to insecure cash dealings increasing risks associated with it.

Dr Ali-Nakyea is of the view that the policy requires further deliberations and analysis, and hence is not ripe for implementation in the state in which it has been proposed.

“If it is about the informal sector, the modified taxation system has been identified as capable of dealing with the sector’s contribution to revenue mobilisation,” he remarked.

Concluding his presentation, Dr Ali-Nakyea noted that the impact of the levy may far outweigh the purported and unlikely revenue envisaged by policy makers.

Adding that there is the need to plug loopholes and leakages of revenue to enhance revenue mobilisation.