Profligate spending may lead South Africa to IMF – Central Bank Governor says

South Africa’s central bank chief said the next government will need to accept it has limited resources or risk having to go to the International Monetary Fund for a bailout.

The African National Congress is weighing options from partnering with the centrist Democratic Alliance to leftist parties to forming a government of national unity, after losing its outright majority in May 29 elections.

Both the Economic Freedom Fighters and former President Jacob Zuma’s uMkhonto weSizwe Party in their manifestos said they want to nationalize mines and banks.

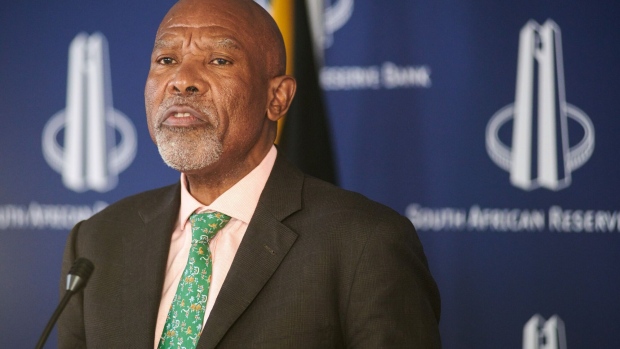

The parties might say that want to nationalize banks, but until that becomes government policy we will not have to respond, Governor Lesetja Kganyago told an event in Johannesburg for the release of the biannual Financial Stability Review on Wednesday.

“If government somehow nationalizes all of these banks, this government will have to borrow a lot of money cause these banks are not particularly cheap at the moment and you are not going to take them for free,” Kganyago said. “Government would easily more than double its debt just to buy the banks.”

The government’s debt to gross domestic product estimated at 74.1% for this fiscal year is already much higher than the emerging market average.

Kganyago said the government will need to consider tradeoffs.

“At the end of the day when you govern, you are going to face the reality that you only have so much resources to work with,” the governor said. “If you try to do things beyond those resources, you are going to end up having to pay for it and it’ll not take long before the funders start saying, I am not funding you anymore.”

When that happens you will be left with only one funder who will come to the party – the IMF, Kganyago said. “They know one thing when they come, they will teach you how to budget and they’ll make you to live within your resources and it’s going to be painful. And you know what? You might not have to drink the medicine. You might have to undergo surgery.”