Republic Bank reports impressive 20.3% growth in total assets value in 2022

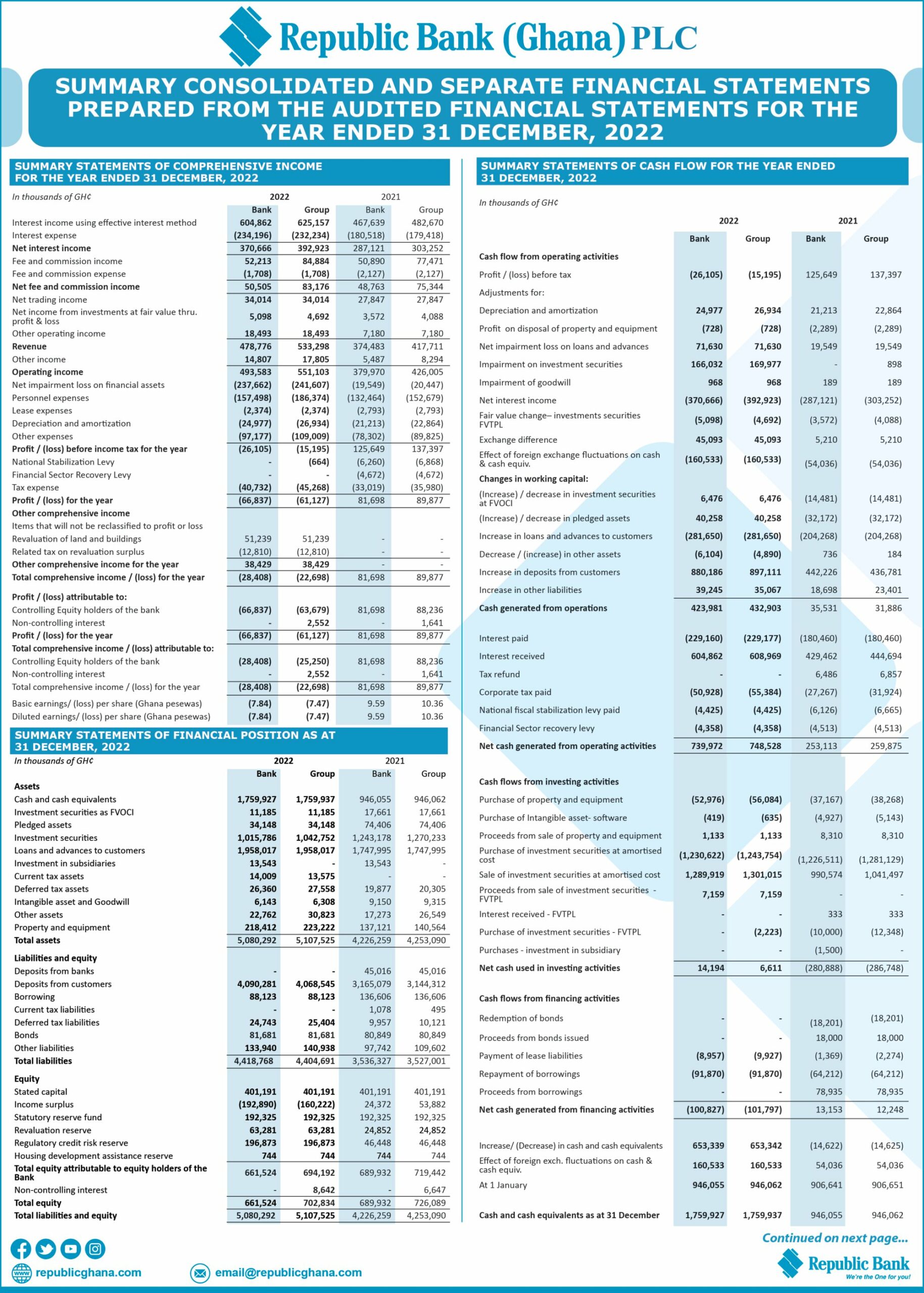

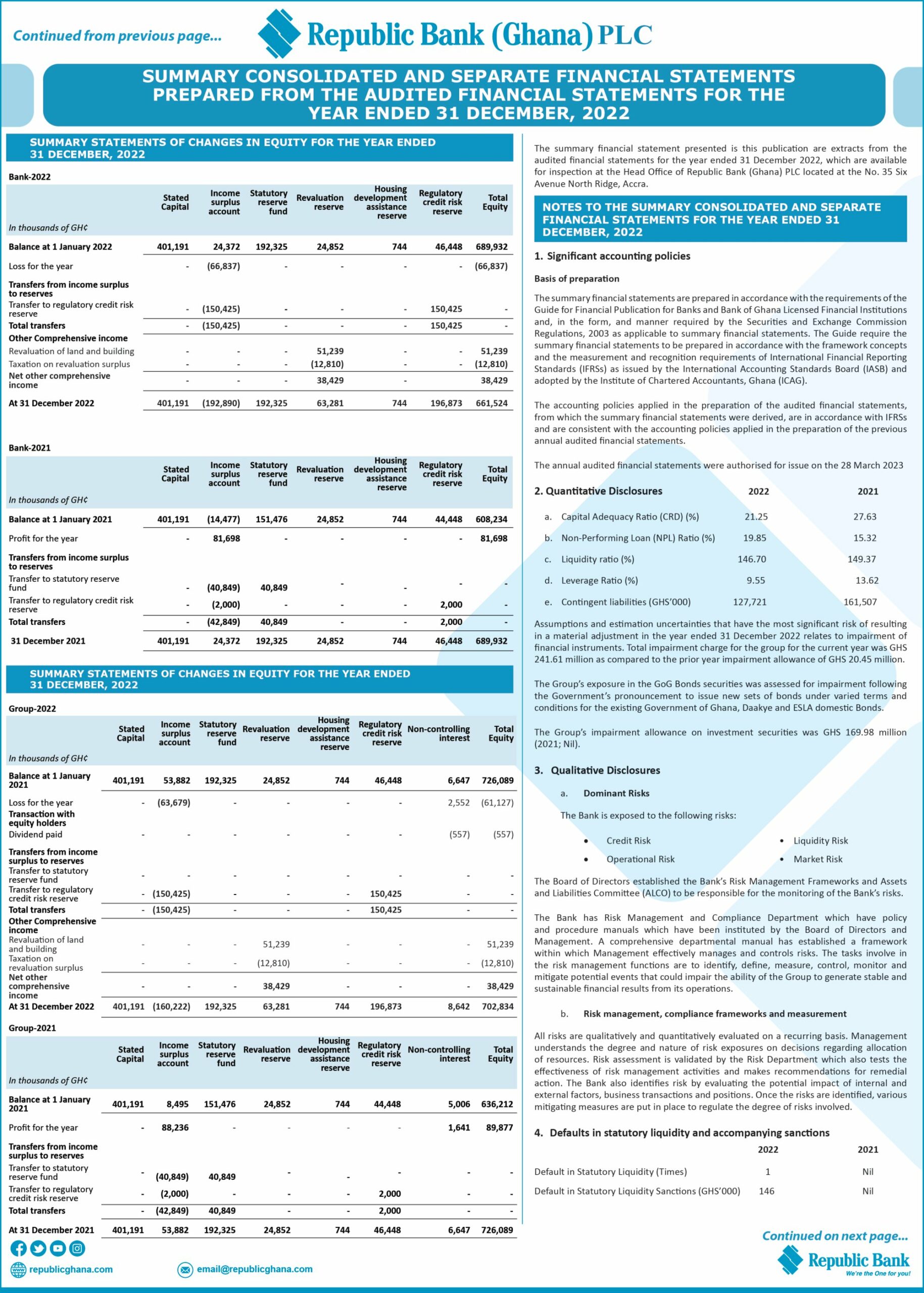

Republic Bank Ghana has reported an increase in its total assets value for the period ending December 2022, with the figure growing to GHS 5.08bn from GHS 4.22bn in the previous year, an impressive growth of 20.3%. This remarkable growth can be attributed to the rise in the bank’s cash and cash equivalents which increased from GHS 946m in 2021 to GHS 1.75bn in 2022.

As much as the increase in the bank’s total assets value was laudable the financial statement also showed the liabilities of the bank recording an increment. The bank’s liabilities rose from GHS 3.53bn in 2021 to GHS 4.41bn in 2022, an increase of GHS 882m. Driving this increase in liabilities was deposits from customers, which amounted to GHS 4.09bn in 2022, compared to the previous year’s figure of GHS 3.16bn.

While the bank’s liquidity ratio remains very strong, recording a liquidity ratio of 146.7% at the end of December 2022, the bank’s loan asset quality was affected. The bank’s non-performing loans grew from 15.3% in 2021 to 19.8% in 2022.

Non-performing loans increase could be attributed to the current economic woes the country is experiencing. The Government of Ghana undertook a debt exchange programme on the domestic front aimed at restoring sound public finance and sustainable debt levels. This resulted in a suspension of coupon payments for Ghana loans forcing bondholders to take a haircut (loss of bond value).

The Capital Adequacy Ratio (CAR) in the year under review fell from 27.6% in 2021 to 21.2% in 2022. It is important to note, however, that despite the decline in the bank’s CAR, it remains well above the regulatory minimum CAR requirement.

Republic Bank Ghana’s impressive growth in the value of its total assets is a result of the bank’s ability to drive an increase in customer deposits.

The bank which is very strong in the Mortgage portfolio may be facing some challenges as customers are not able to pay back loans due to the high inflationary and interest rate environment coupled with the domestic debt exchange programme which has hit many individuals and banks in Ghana.

Ghana is currently discussing with the IMF to seek concessionary funding which will be used to shore up the balance of payments account.

The IMF in its latest economic outlook revised Ghana’s economic growth to just 1.6% as it continues to expect the country to experience economic headwinds.

Peruse details of report below: