Societe Generale leads banks with highest NPS score of 43.2 – Global InfoAnalytics report

Global InfoAnalytics in its half-year Bank Brand Health report, notes that Ghana’s banking landscape witnessed a surge in Net Promoter Scores (NPS), signifying a noteworthy progression in customer satisfaction.

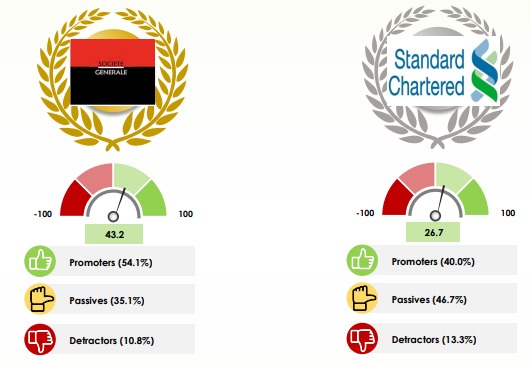

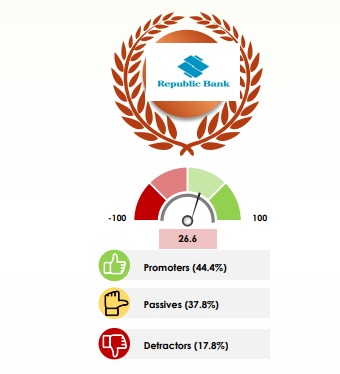

Notably, Societe Generale Ghana, Standard Chartered Bank, and Republic Bank emerged as the top three industry leaders with the highest NPS, paving the way for increased customer advocacy.

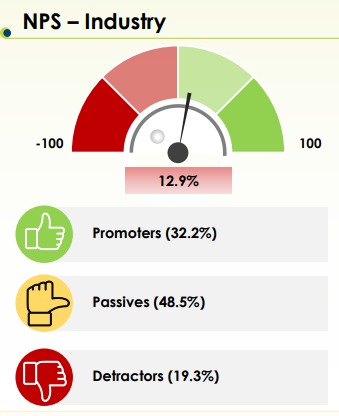

The banking industry’s collective NPS witnessed a commendable upturn, standing at 12.9%, exhibiting a promising improvement compared to the results recorded in December 2022. However, a sizeable proportion of “passives” remains, accounting for 48.5% of respondents, showcasing a potential area for further enhancement in customer experience to fortify NPS figures. Though a step in the right direction, the industry as a whole still faces the challenge of fostering unwavering customer loyalty.

Astonishingly, Societe Generale Ghana demonstrated an unprecedented turnaround, transforming its NPS from a dismal -14.3 in December 2022 to an impressive 43.2, effectively dislodging the competition and capturing the leading position.

Likewise, Standard Chartered Bank rebounded significantly from a troubling -36.4 in December 2022 to attain an inspiring NPS of 26.7, subsequently edging out Prudential Bank. Republic Bank showcased remarkable resilience, securing the third position with an NPS of 26.6 after grappling with a -20.5 score in the preceding year.

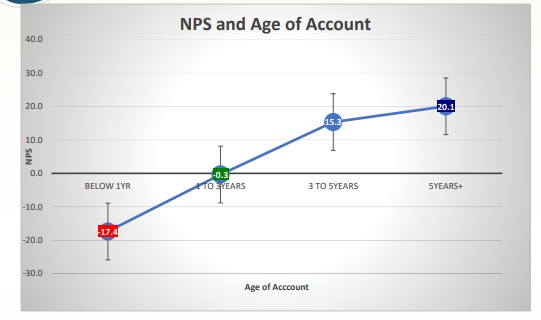

The report further highlighted a compelling positive correlation between NPS and the tenure of account holders. Customers with accounts under a year exhibited a notable improvement in NPS, rising to -17.4 from the previous -31.06 recorded in December 2022.

On the other hand, long-standing account holders, with five years or more tenure, showcased a remarkable transformation with an NPS of 20.1, a stark contrast from the modest 2.33 in the prior year.

To bolster NPS figures and cultivate a loyal customer base, the report advises banks to adopt strategic initiatives. Initiatives such as establishing robust Voice of the Customer (VoC) analysis and Customer Experience programs to understand and address detractors’ concerns, and swiftly converting passives into promoters through active engagement and feedback assimilation, are paramount.

Leveraging feedback from satisfied customers can also unlock the secret to elevating products and services from mere adequacy to unparalleled greatness.

With banks in Ghana attaining commendable progress in enhancing customer loyalty, the industry finds itself at a critical juncture to embrace transformative practices and capitalize on the newfound momentum.

As the pursuit of customer satisfaction remains steadfast, the financial community keenly watches the Ghanaian banking sector’s trajectory, expecting a trajectory of unwavering growth and prosperity.