South Africa Sees Breakthrough as Ramaphosa Reforms Win S&P Nod

A turnaround that investors have bet on in South Africa since President Cyril Ramaphosa returned to power on a mandate for reforms is coming true — at least in the nation’s credit outlook.

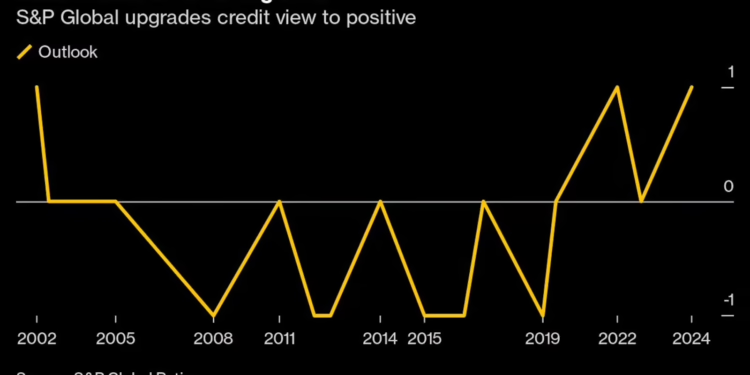

The rand and South African bonds rallied on Monday after S&P Global Ratings raised its view of the nation to positive from stable — for only the second time in the president’s six-year tenure. The move indicated the ratings company’s next move may well be an upgrade of the credit grade.

S&P’s move validates bulls who backed Ramaphosa’s government of national unity as the right recipe for carrying out tough reforms needed to pull South Africa out of an economic slowdown, burdensome debt and persistent power crisis. That optimism has already sent the nation to some of the best performances in emerging markets: its local-currency bonds have given investors 19% returns since the election, dollar bonds have yielded almost 7% and the currency carry trade posted a gain of 5.6%.

“S&P’s change in South Africa’s outlook to positive, on the basis that growth could improve from here on, will likely be looked at as a relative turning point for South Africa,” said Razia Khan, chief economist for Africa and the Middle East at Standard Chartered Plc.

That is a rare reprieve for Ramaphosa, under whose watch South Africa lost its investment grade in 2020, and the ruling African National Congress lost its parliamentary majority this year.

Potential Upside

Investor confidence in South Africa had already strengthened following the GNU’s formation under Ramaphosa in June, Khan said. In addition, S&P’s ability to focus on potential upsides despite the downbeat news in the Medium-Term Budget Policy Statement “signals that rating agencies are rightly focused on the potential upsides ahead,” she said.

South Africa’s currency extended its outperformance over EM peers on Monday, rallying to the strongest level in a week, after S&P moved the outlook for its junk-rated debt to positive from stable. The company also affirmed South Africa’s long-term foreign-currency rating at BB-, three notches below investment grade.

The currency strengthened 0.5% to 18.1062 per dollar as of 1:34 p.m. in Johannesburg. Yields on 10-year local-currency bonds fell to their lowest levels since Oct. 2.

An outlook upgrade to positive signals a one-in-three chance of a higher rating within 12 months, according to S&P. South Africa last received this outlook in May 2022, only to see it downgraded to stable in 2023. However, in November 2002, a similar change to positive was followed by a rating upgrade six months later.

In less than six months of the new government, Ramaphosa has already initiated key reforms to address economic, energy, and governance challenges facing South Africa. Notable efforts include stabilizing the electricity grid through private-sector investment and renewable energy projects, modernizing logistics and water infrastructure via Operation Vulindlela.

Yet, the rand’s path hasn’t been smooth in these months. Especially since the US election on Nov. 5, the entire EM complex has faced pressure and the rand, often seen as an EM bellwether, has also surrendered a lot of its gains.

To some investors, however, that only makes South African assets more attractively valued.

“We believe that South Africa is likely to be one of EM investors’ top picks in the coming months,” said Marek Drimal, lead CEEMEA strategist at Societe Generale’s London Branch. Reforms are a positive driver, while on a broader scale, South Africa may stand out “due to the lack of alternatives, given uncertainties surrounding other regions due to geopolitics or the impact of possible US tariffs,” he added.

Mamokete Lijane, global markets strategist at Standard Bank Corporate and Investment Banking, echoed the sentiment, citing China and sustained positive momentum as reasons to remain “constructive” on the rand.