Who is behind Africa’s debt trap?

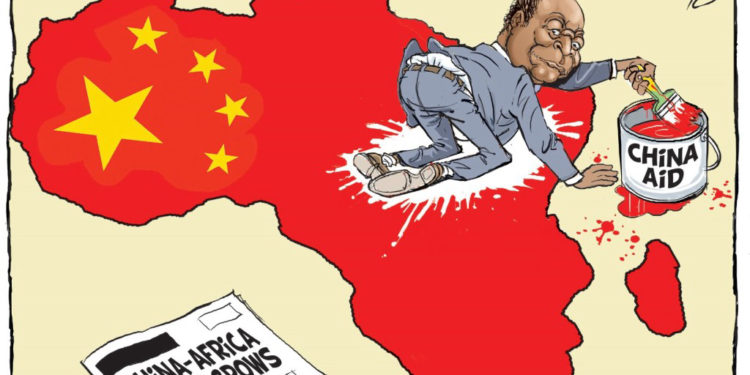

China has emerged as a global leader in international development financing in the 21st century, and the Bank for International Settlements now ranks China as the sixth-largest international creditor globally. The Western countries have expressed concern over the emergence of the so-called “new colonialism” as a result of the growing ties between China and Africa.

Chinese lending practices toward developing countries have generally been portrayed in recent years as “debt-trap diplomacy.” But a factual analysis of lending by China and other creditors to Africa paints a different picture.

Professor Justin Yifu Lin, former Chief Economist and Senior Vice President of the World Bank, told ChinAfrica that countries are trapped in debt when they are unable to grow economically and cannot export to earn revenues or income that would allow them to repay their debts.

Who’s really debt-trapping Africa?

The “China’s debt-trap diplomacy” narrative emerged at a time when the U.S. was becoming increasingly concerned about China’s rise on the world stage, which is when the debt-trap theory became popular among many journalists, scholars and politicians. The U.S. Government has adopted this description as part of a diplomatic offensive to weaken China’s ties with developing countries.

Lin affirmed that most discussions related to “China’s debt-trap diplomacy” are based on fiction rather than on reality. He acknowledged that quite a number of African countries do have troubles of debt; but a clear look into the highest indebted countries shows that most of their debt are from Western countries.

“Even in the case of the highest indebted country, the Chinese debt accounted only for [roughly] 20 percent of its total outstanding debt. If they are deemed to be in a debt trap, then they are trapped by other creditors, not China,” he added.

This was corroborated by a report released on July 11 by Debt Justice, which revealed that African governments owe three times more debt to Western banks, asset managers and oil traders than to China, and these governments are charged double the interest.

The Debt Justice report shows only 12 percent of African debt is owed to China, and the interest rate is 2.7 percent. Contrary to the Chinese lenders, the Western creditors are owed 35 percent of Africa’s external debt, with the highest interest rate of 5 percent, almost two times the interest rate charged by China.

Western predatory practices

The World Bank reported that the African countries’ external debt owed to the private creditors (Chinese ones not included) amounts to $247 billion. Of these, the Organization for Economic Co-operation and Development (OECD), an international organization of 38 countries, accounts for $42.9 billion. The remaining amount of debt (about $204 billion) are external bonds, 99 percent of which are governed by British and U.S. laws.

This creates difficulties once some debt-distressed countries try to apply for debt relief because they are confronted by these organizations’ lawyers who end up nullifying the applications. It is noteworthy that 95 percent of external bonds are owned by private companies from the U.S., UK, EU or Switzerland.

In addition to the fact that the above non-flexible creditors have issued the highest amount of debt to the African countries, they have not implemented the Debt Service Suspension Initiative (DSSI) to respond to debt and economic distress expected from the COVID-19 pandemic. China, however, reported in February 2021 that their official bilateral creditors had provided G20 DSSI relief to 16 African countries.

Since almost all of the international debt contracts are governed by U.S. laws and the maximum of bond contracts by British laws, there is a strong need for Western governments to make legislation that encourages private lenders to take part in the debt restructuring. Top leaders of the World Bank and the International Monetary Fund have called on the UK and the U.S. to regulate the private lenders so as to continue the practice of restructuring debt for those countries which are in debt distress.

Consumption versus production debts

Lin highlighted some key points about the Chinese debt to African countries. He believes that African countries shouldn’t worry about the debt; they should rather understand that the debt viability depends on whether it stimulates economic growth and boosts export earnings or not.

“There is a clear disparity between Chinese loans and other countries’ loans. Most loans from China are used to support the investment to empower growth, building the foundation for countries to grow, while the loans from other countries in general are used to support the government budget spending. They may certainly have good intentions, but they are supporting consumption instead of supporting production,” he observed.

Most Western countries whose debts support consumption are incessantly using the debt-trap narrative to blame China because of geopolitical considerations. This narrative is not for the benefit of African people, it’s rather for their own interests. However, due to the control they have over the global media, it is easier for them to use propaganda and set the agenda for the audience.

Eric Olander, Editor in Chief of China Africa Project, endorses the idea of focusing on data as it is, instead of giving credit to narratives and storytelling which bring about fantasies that some African countries are going to be taken over by China. “One country cannot take over another country just by owning 4 percent to 10 percent of its debt,” he vigorously stated.

As illustrated earlier, most of the countries’ debts that are said to have been borrowed unsustainably are not from China, and the small percentage that China lends to them is used to utilize their resources to boost growth, production, job creation and exports. It is very important to differentiate debt for consumption from debt for production.

“The issue is not the debt level but the debt-to-GDP ratio; the main problem emerges when a country is economically stagnant. If a country does not grow economically or doesn’t export to earn some income to repay, it gets into debt problems,” Lin said.

He presented a scenario whereby a country with a high debt-to-GDP ratio of 70 percent but growing very fast and exporting a lot of commodities would be in the best position to repay the debt (interest and the capital). On the contrast, another country that has a low debt-to-GDP ratio of 10 percent but lacks the capability to grow and export would have difficulty paying back the debt.

If a country needs to grow economically, it needs to develop sectors such as agriculture, mining, and industries, according to its competitive advantages. The competitive advantages lower the production cost. Lin noted that Africa needs massive infrastructure and industrial transformation, both of which require loans.

“So, if China can help bring the funds to improve power supply, road connectivity, even if it may increase the debt, African countries can make people productive to generate wealth,” Lin concluded.

This article was first published in ChinAfrica magazine