SSNIT’s Spiralling Crisis: A closer look at management woes and the future of workers’ pensions I

Introduction

The Social Security and National Insurance Trust (SSNIT) is a critical institution designed to secure the financial futures of Ghanaian workers through pension and insurance schemes. However, an examination of the audited financial statements for the year ended 31 December 2021 raises significant concerns about the management of this vital institution, particularly regarding the influence of government appointees affiliated with the New Patriotic Party (NPP) on its decision-making processes.

Financial Performance Analysis

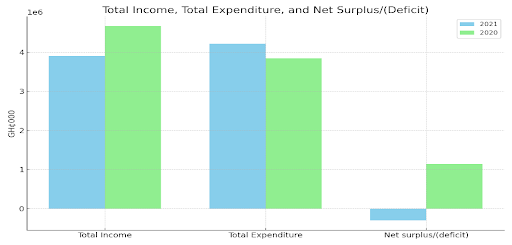

In stark contrast to a surplus of GH¢1,141,873,000 recorded in 2020, the SSNIT reported a substantial deficit of GH¢301,097,000 for the year ended 31 December 2021, marking a decline of 126.4%. This alarming downturn in financial health can be attributed to a series of questionable management decisions, heavily influenced by undue interference from NPP government appointees.

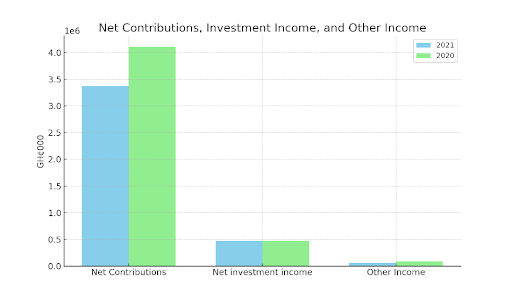

The financial year 2021 witnessed a significant decrease in total income, primarily due to an 18.0% reduction in net contributions received, dropping from GH¢4,106,623,000 in 2020 to GH¢3,368,335,000. This decline reflects poorly on the institution’s capacity to effectively manage and grow its primary revenue stream, a situation exacerbated by political appointments lacking the requisite expertise in financial management and social security administration.

Moreover, the total expenditure saw a 9.6% increase from GH¢3,847,254,000 in 2020 to GH¢4,217,700,000 in 2021, with benefits payment witnessing a 9.9% rise. This increase in expenditure, against the backdrop of declining income, underscores a lack of fiscal discipline and strategic planning, likely influenced by politically motivated decisions rather than prudent financial management practices.

Financial Position and Mismanagement

The Trust’s financial position as of 31 December 2021 further highlights the dire consequences of mismanagement under the influence of NPP government appointees. While non-current assets saw a 13.6% increase and current assets a marginal 0.9% rise, current liabilities surged by 30.6%, indicating a significant increase in payables. This escalation in liabilities, coupled with a deteriorating current ratio from 1.8:1 in 2020 to 1.4:1 in 2021, signals a troubling inability to meet short-term obligations, posing a risk to the Trust’s operational viability.

The deterioration in the Trust’s financial health can be directly linked to the undue influence of NPP government appointees, who have prioritized political interests over the institution’s core mission of serving Ghanaian workers. The appointment of individuals based on political affiliation rather than competence has led to a series of misjudgments and inefficiencies, compromising the integrity and sustainability of the Trust.

Future of Worker Pensions

The adverse effects of the current mismanagement within SSNIT, exacerbated by political interference, have profound implications for workers’ pensions, directly threatening their financial security in retirement. As the institution faces financial deficits and struggles with its short-term obligations, the sustainability of pension funds becomes increasingly precarious.

This situation is likely to result in delays or reductions in pension benefits for retirees, undermining their ability to meet basic living expenses. Furthermore, the declining confidence in the institution’s ability to manage these funds effectively may deter current workers from contributing, thereby weakening the fund’s financial base even further.

This vicious cycle of mismanagement and underfunding poses a significant risk not only to the current retirees but also to the future pensioners, potentially compromising the quality of life for thousands of workers who have depended on SSNIT for their post-retirement security. It underscores the urgent need for systemic reforms to ensure that the institution can fulfil its promise of providing a stable and reliable pension to Ghana’s workforce.

The alarming developments at SSNIT call for immediate action from influential labour unions such as the Ghana National Association of Teachers (GNAT), Ghana Trades Union Congress (TUC), and the National Association of Graduate Teachers (NAGRAT). These organizations must champion the cause of workers by vehemently opposing the politicization of pension management and advocating for reforms that prioritize the financial security of their members.

It is imperative that they leverage their collective voice and bargaining power to demand transparency, accountability, and professionalism in the administration of SSNIT. By organizing forums, engaging in dialogue with policymakers, and possibly taking to the streets in peaceful protest, these unions have a pivotal role in safeguarding the pensions of Ghana’s workforce. Their active involvement and relentless advocacy are crucial in ensuring that the retirement funds of hardworking Ghanaians are managed with the utmost integrity, free from political interference, and aligned with the best interests of the contributors.

Conclusion

The SSNIT’s financial struggles in 2021 are not merely a reflection of operational challenges but are indicative of deeper issues of governance and political interference. The undue influence of NPP government appointees on management decision-making has resulted in a lack of strategic direction, fiscal indiscipline, and a departure from the institution’s foundational objectives.

To safeguard the financial futures of its contributors, it is imperative for SSNIT to reevaluate its governance structure, ensuring that appointments are made based on merit and expertise rather than political considerations. Only through such reforms can the institution regain its footing, restore public trust, and fulfil its mandate of providing secure and reliable social security benefits to the Ghanaian workforce.

Dear Author,

I recently read your article, and I want to offer some constructive feedback. While I appreciate the effort you put into writing it, I found several areas that could be improved upon.

Firstly, I must express my disappointment in the lack of factual accuracy in your article. It appeared to be riddled with innuendos and conjecture, lacking substantial evidence to support its claims.

It is evident that SSNIT has historically had political appointees at the upper echelons of the institution. This hierarchical structure was introduced during the administration of President Mahama. However, it is essential to critically examine whether this hierarchy has indeed improved efficiencies within SSNIT operations or has simply added to the taxpayer’s burden.

I had hoped to see an analysis of how the actions of SSNIT’s leaders contributed to the deficit observed in 2021. Unfortunately, the article seemed more focused on making assertions and casting aspersions on the leaders, rather than presenting a balanced and evidence-based assessment.

It is undeniable that SSNIT faces significant challenges, operating within an economy that is itself under strain. Benefit payments, in particular, represent a substantial and uncontrollable expenditure for the institution.

In conclusion, I urge you to prioritize factual accuracy and evidence-based analysis in your future articles. Without these foundational elements, your article is akin to a soup without meat – difficult to digest and lacking in substance.

Thank you for considering my feedback.

Best regards,

Nat Asuah