The Ghana Fuel Price Trap: Why Oil-Rich Doesn’t Mean Cheap Fuel Prices

Yakubu Adam, Graduate Student (Energy and Environmental Policy, Joseph Biden Jr. School of Public Policy & Administration, University of Delaware)

Every Ghanaian at a fuel pump in recent months has asked the same question: why is fuel so expensive in an oil-producing country? The frustration is palpable for drivers, business owners, and households. We are told prices are shaped by global markets, exchange rates, and taxes. Yet when global crude prices fall, Ghana’s pump prices barely budge. This isn’t simply an economic inconvenience; it is a national crisis that fuels inflation, erodes incomes, and undermines confidence. What Ghana needs is not more excuses, but a bold and forward-looking policy shift.

Combing Through History: Ghana’s Fuel Pricing (1994-2024)

- The Global vs. Local Story

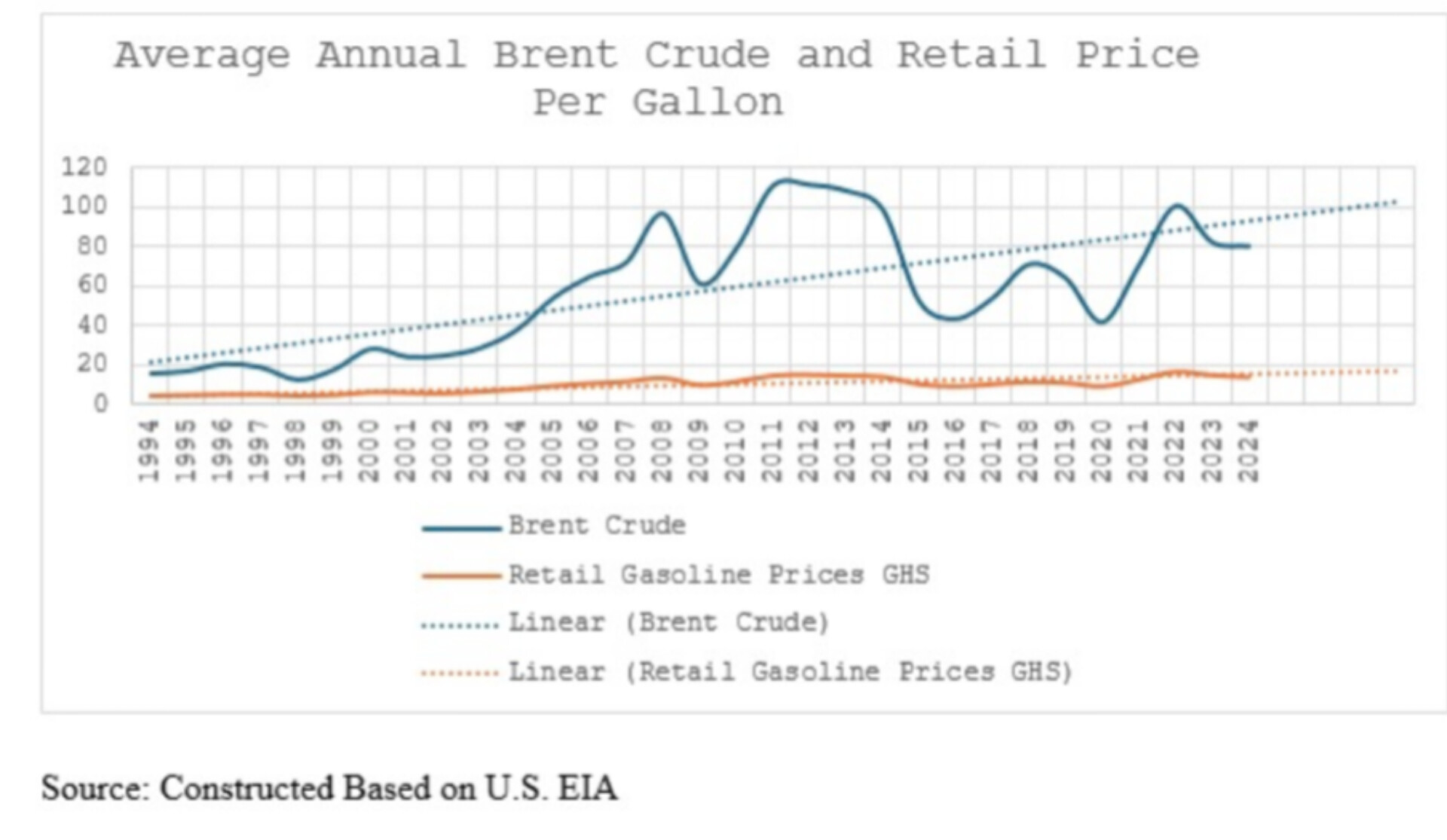

Global crude oil prices, as measured by Brent, have swung wildly between 1994 and 2024, spiking in 2008, collapsing in 2014–16, plunging during COVID-19, and surging again after the Russia–Ukraine war.

Source: Constructed Based on U.S. EIA

But Ghana’s retail pump prices tell a very different story: a smoother, stubbornly upward trend. The divergence highlights how domestic factors, particularly the cedi-dollar exchange rate, import costs, and an array of taxes and statutory levies, dominate the long-term retail price. Economists call this “incomplete pass-through”: global declines in crude prices rarely translate into meaningful local relief.

The Policy Shifts That Locked in Today’s Prices

Over the past three decades, a series of reforms fundamentally reshaped Ghana’s downstream fuel market. Each was designed with good intentions, stability, efficiency, and debt recovery, but together they entrenched the very “stickiness” that now frustrates consumers.

- 2005–2008: Reform Era (NPA/UPPF)

The creation of the National Petroleum Authority (NPA) formalised an import-parity pricing regime, while the Unified Petroleum Price Fund (UPPF) was established to subsidise transport costs and ensure uniform nationwide prices. Crucially, this era embedded statutory margins and levies into the pricing structure, components that do not fall even when global crude prices decline. - 2015: Deregulation Pivot

The government removed subsidies and allowed Oil Marketing Companies (OMCs) to set pump prices based on an NPA formula. Intended to foster competition, deregulation instead tied prices directly to OMCs’ foreign exchange assumptions and margins. This further decoupled local pump prices from the movement of crude oil alone. - 2015–Present: Levy Architecture (ESLA and Beyond)

The Energy Sector Levies Act (ESLA) introduced new charges, including the Price Stabilisation and Recovery Levy, to pay down energy-sector debt. Over time, additional statutory charges, from BOST margins to sanitation and UPPF levies, were layered on. These levies are structurally “sticky”: they rarely move downward, even when global conditions improve, creating a persistent upward drift in pump prices.

Understanding Ghana’s Fuel Price “Stickiness”

In economics, price stickiness, often called downward stickiness, describes the resistance of prices to fall even when market conditions improve. Ghana’s fuel market is a textbook example. When global oil prices drop, local pump prices rarely follow in proportion. Instead, they remain elevated because the pricing framework is built on two anchors: fixed domestic costs (taxes, levies, margins) and a high sensitivity to the exchange rate, which frequently moves in the opposite direction of global crude.

Three main factors explain Ghana’s downward price stickiness:

- Exchange rate depreciation. With over 80% of petroleum products imported, a weakening cedi immediately offsets crude oil declines.

- Tax rigidity. Levies and margins are politically sticky; once imposed, they rarely move down, even in times of global relief.

- Import-parity pricing. Benchmarking against world market prices and freight costs ensures that even with falling crude, local costs remain elevated.

The net effect: Ghana’s pumps are built to rise, and reluctant to fall.

Again, let me say that at the pump, Ghana’s price is not just a reflection of Brent crude. It is the sum of multiple layers:

- International Product Cost (USD): The price of imported refined fuels, not raw crude.

- Exchange Rate (FX): The cedi–dollar conversion, which often offsets global declines when the cedi weakens.

- Taxes and Levies (GHS): Charges under ESLA and other statutory regimes that rarely decrease.

- Distribution Margins (GHS): Administered margins for Oil Marketing Companies, BOST, and the Unified Petroleum Price Fund (UPPF).

Together, these components create a structural bias: Ghana’s fuel prices rise quickly when global markets tighten, but fall slowly, if at all, when they ease.

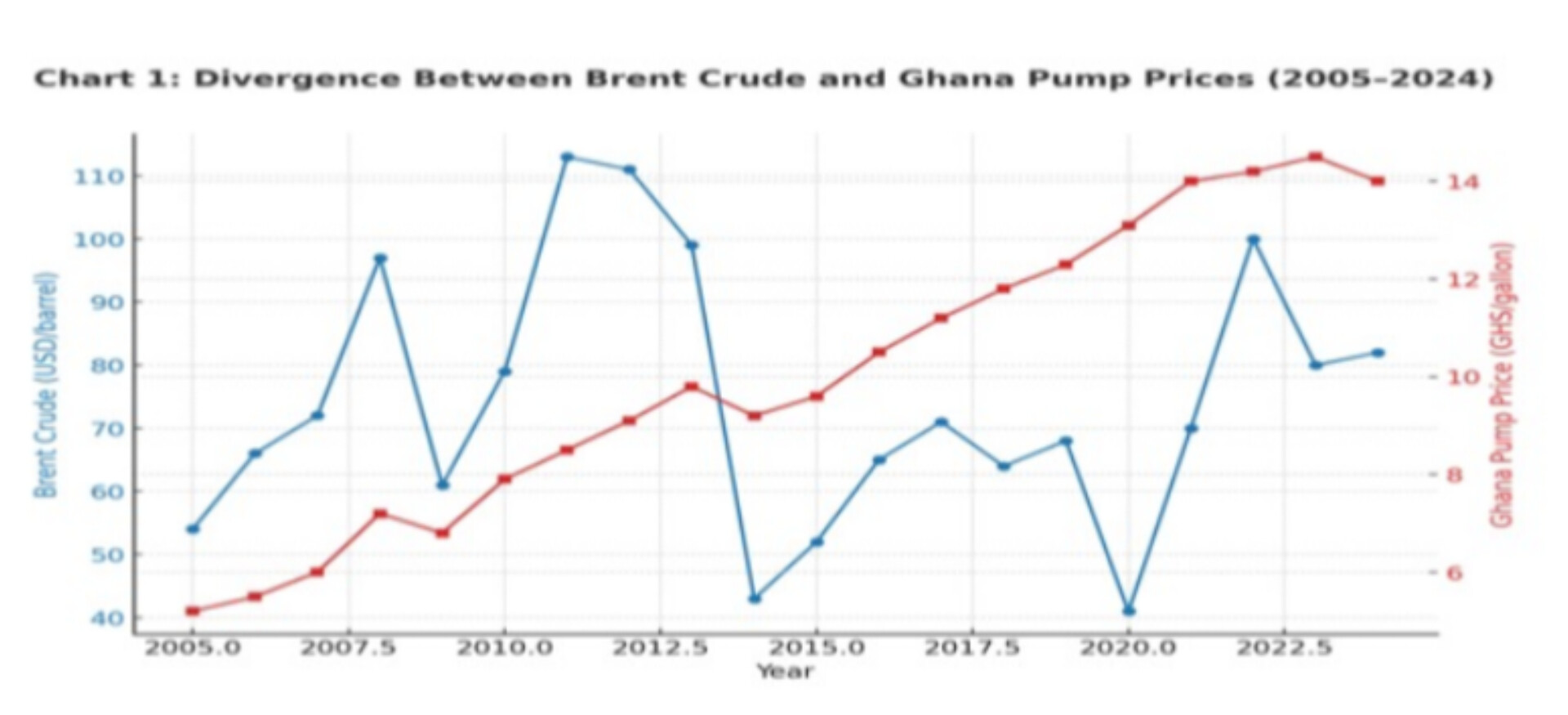

When Global Oil Prices Fell, Ghana’s Didn’t

Ghana’s fuel market repeatedly demonstrates a pattern of downward stickiness—pump prices do not fall in line with global declines. Three recent episodes illustrate this clearly:

- 2014–2016 (Brent –56%, Ghana –27%)

A global price crash was softened locally by a weakening cedi, new industry margins introduced under deregulation, and the rollout of fixed levies such as ESLA. These factors blunted the relief that consumers might otherwise have felt. - 2020–2021 (COVID Crash)

Even as Brent collapsed, Ghana’s pump prices rose. A fragile cedi, elevated import costs for refined products, and an expanding share of fixed taxes and margins outweighed the fall in global benchmarks. - 2022–2023 (War & Inflation)

The Ukraine war sent global prices soaring, but in Ghana, the shock was magnified by hyperinflation above 54%. Skyrocketing local distribution costs, coupled with immovable statutory taxes, kept pump prices anchored painfully high.

The lesson is consistent: a weakening currency and an expanding layer of fixed domestic charges insulate Ghanaian consumers from global relief, entrenching a structural price stickiness that continually harms households and businesses.

Policy Options

- Do Nothing

Maintaining the status quo leaves pump prices entirely at the mercy of global crude swings, cedi depreciation, and Ghana’s rigid tax-and-levy system. While this option requires no fiscal outlay, it guarantees continued volatility, higher costs for households and businesses, and mounting public frustration. - Revise the Tax Framework

Taxes and levies currently account for an estimated 40–45% of the pump price. Reducing or restructuring them could provide short-term relief. The trade-off, however, is steep: revenue losses that finance infrastructure, energy-sector debt repayment, and social spending. In effect, this option swaps immediate political popularity for long-term fiscal strain. - Public–Private Partnerships for Strategic Petroleum Reserves

A more sustainable approach is to build reserves when global prices are low and release them during spikes. Anchored at BOST’s nationwide depots and financed through PPPs, reserves would smooth shocks without overburdening the state. By sharing costs with private partners, this model avoids the pitfalls of subsidies while offering a credible stabilising tool. - Boost Domestic Refining Capacity (TOR)

Rehabilitating or expanding the Tema Oil Refinery could reduce Ghana’s dependence on imported refined products and trim import premiums. TOR’s tank farms, laboratories, and technical know-how remain strategic assets. But upgrading it to global standards is capital-intensive, time-consuming, and fraught with financing uncertainty, making this a slow-burn option. - Hybrid Model: Strategic Reserves + TOR Integration

The most pragmatic solution combines the strengths of both approaches. Strategic reserves, anchored at BOST and supported by PPPs, provide immediate stabilisation against volatility. At the same time, a phased TOR rehabilitation offers medium to long-term resilience by adding local refining capacity and quality control. Together, they form a credible path to both price stability and energy security.

Conclusion

For three decades, Ghanaians have lived with a frustrating paradox: when global oil prices fall, our pump prices barely move. The reasons are structural, a weak cedi, heavy import dependence, and a tax-and-levy regime that locks prices upward. Cutting taxes offers fleeting relief at the expense of public finances, while building new refineries is too costly and slow to solve the immediate problem.

The credible path forward is a hybrid solution. By leveraging existing assets, BOST’s nationwide depots and TOR’s technical capacity, Ghana can build a two-layered shield: strategic reserves to stabilise short-term shocks and a phased rehabilitation of domestic refining for medium-term resilience.

This is not a false choice between a quick fix and a distant dream. It is a practical, fundable strategy, achievable through public–private partnerships, that aligns today’s resources with tomorrow’s energy security. The time for action is now: Ghana must build a fuel system that delivers both immediate relief and enduring stability, protecting households while securing prosperity.

Insightful and informative