Trade Associations raise concerns over harassment by GRA officials

Ghana, long seen as a leading and favorable destination for business and investment, is facing a number of challenges that threaten its attractiveness to foreign direct investment (FDI). Major multinational companies have been drawn to the West African nation due to its relative peace, strong democratic culture, good governance, rule of law, educated workforce, and welcoming population. However, a group of bilateral trade associations representing the interests of international and local companies operating in Ghana has raised concerns about issues that could impede the country’s long-term growth and prosperity.

One of the primary concerns of the group is the perceived predatory nature and outright harassment by Ghana Revenue Authority (GRA) officials in the conduct of audits and the resulting imposition of penalties on large taxpayers. While the group endorses initiatives to mobilize domestic revenue for the country’s development, its members expect greater consultative opportunities in the development and rollout of tax reforms. The imposition of penalties on companies that are already large taxpayers could deter FDI and undermine Ghana’s reputation as a welcoming destination for business.

Another issue identified by the group is the need for harmonization of legislation, rules, and regulations to spur coherent private sector participation in the economy. While the group fully supports and encourages local content development and participation, the rigidity of localization regulations is threatening investments in the mining, energy, and digital/communications sectors. Such regulations can create barriers to entry for foreign companies, which may have a negative impact on FDI.

Delays in payment for the supply of government goods and services and challenges with contract sanctity and perceived lack of transparency and interference with government-to-business contracts also pose a threat to Ghana’s attractiveness as a business destination. Inconsistent business conditions can deter investors, particularly when word spreads fast about deteriorating business conditions. The group emphasizes the importance of a consistent and predictable business environment for smart investment.

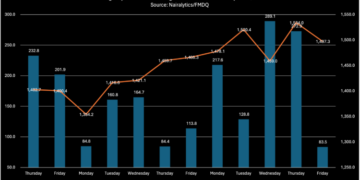

The depreciation of the Ghanaian currency is another concern raised by the group. In 2022, the currency lost more than 50% of its value against major currencies. The group stands in solidarity with efforts to stabilize the currency, but also urges the Bank of Ghana (BoG) to maintain an open and fair line of communication with investors on the issue of repatriation of profits and the availability and management of foreign exchange for businesses to import essential inputs for manufacturing. Additionally, the BoG must publicly communicate the modalities on its outright cessation of providing foreign exchange for some critical imports to avoid likely shortages.

Lastly, the group intends to collaborate more closely with local trade groups on matters of mutual concern, particularly on using more local content in manufacturing. By working together, international and local trade groups can create a more positive business environment for all stakeholders.

In conclusion, while Ghana remains an attractive destination for FDI, the concerns raised by the bilateral trade associations cannot be ignored. The government must address these issues to ensure a consistent and predictable business environment that encourages investment and growth. The private sector, which the group believes can provide the needed resources for Ghana’s long-term growth and prosperity, needs the right incentives and operational flexibility with less interference from the government. If these concerns are not addressed, Ghana risks losing its position as a major commercial hub for the continent.