Traditional German, Swiss chocolate makers feel the cocoa crunch

Chocolate sommelier Karin Steinhoff went to an Amsterdam warehouse recently to buy cocoa beans for her boutique German producer. But when she walked inside the cavernous building with her trader, they were struck by how unusually empty it was.

Meager harvests in West Africa are significantly cutting into the crop’s availability, catapulting futures above a record $10,000 a metric ton and squeezing bottom lines for suppliers and manufacturers. Steinhoff ended up spending at least 40% more per kilogram than the firm did last July.

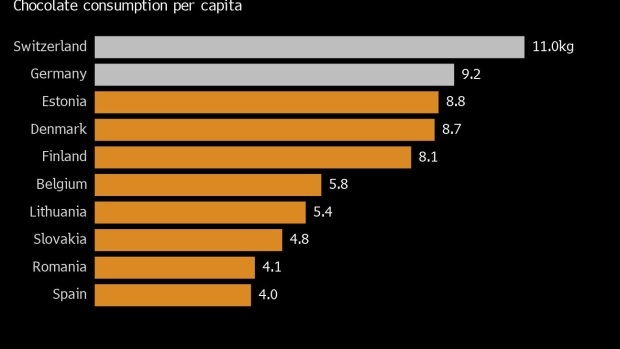

Severe weather, plant diseases and years of low pay in cocoa-farming hubs have strained producers to the point where global output is expected to contract by 11% this season. That’s especially bad news in chocolate heartlands Germany and Switzerland, nations famed for making top-quality bars and for eating more of them per capita than anywhere else.

“This is a wake-up call for many in the industry because things obviously cannot continue as usual,” said Steinhoff, who works for the company Georgia Ramon. “Going forward, chocolate is simply going to be more like a little luxury.”

Cocoa’s relentless price rally is driving food inflation, but there’s also fear it may push some makers into insolvency, furthering a consolidation sparked by the pandemic. Earlier this year, German confectioner Hussel GmbH filed for bankruptcy again because of surging costs for raw materials and labor. The Austrian maker of Mozartkugel sweets went broke in 2021 and was later acquired.

“The concentration of the confectionery industry will be further accelerated by this cocoa price increase because not everyone will be able to pass on the price rise,” said Hermann Bühlbecker, owner of Aachener Printen-und Schokoladenfabrik Henry Lambertz GmbH & Co. KG.

Across the European Union and Switzerland, the chocolate, biscuit and confectionery industry employed more than 250,000 people in 2020 and created about €14 billion ($15 billion) worth of exports, according to the Caobisco trade group representing more than 13,000 companies.

About 99% of those members are small- and medium-sized enterprises that lack the scale and clout of corporations able to absorb wild commodity price swings.

“The extent to which a company has hedged itself at lower cocoa bean prices is crucial for 2024 and 2025,” said Patrik Schwendimann, a senior equity analyst for food and luxury goods at Zürcher Kantonalbank.

Even the world’s largest maker of bulk chocolate, Barry Callebaut AG, is struggling with rising cocoa prices.

The Swiss company’s market valuation has plummeted about 30% in the past year, and it cut about 18% of its work force, closing factories near Hamburg and in Malaysia as part of a transformation. Revenue for the first half of fiscal year 2024 was above expectations, but a negative free cash flow of 1.12 billion francs ($1.2 billion) shows the cost burden of bean purchases.

Georgia Ramon, a small bean-to-bar maker, caters to a clientele that’s used to paying higher prices for its specialty chocolate. The firm is considering other ways to cut costs and limit the burden on customers, Steinhoff said.

But for others, managing the higher expenses may prove more challenging. Many confectionery makers have contracts with retailers to sell their products at certain prices. Those running low on beans or chocolate may find it more difficult to cover their costs.

“There’s still robust demand for high-quality products, both for gifting and treats,” Bloomberg Intelligence senior analyst Diana Gomes said. “For more mass-market brands, which make the bulk of the chocolate confectionery industry, the opposite is happening.”

Lambertz makes baked goods like chocolate-covered gingerbread that are as essential to German holiday traditions as mulled wine and Christmas markets. Cocoa and sugar make up about 70% of the commodity costs, and the company isn’t sure yet by how much it will need to raise prices by winter.

“It’s yet another complication for the confectionery industry, which was already under pressure after Covid and as a result of the price increases after the start of the Ukraine war,” Bühlbecker said. “And that will lead to further concentration.”

Chocolats Camille Bloch SA, Swiss maker of Ragusa and Torino bars, recently announced price hikes after trying to cut costs without laying off full-time employees.

The company decided in 2022 to source its yearly 400 tons of cocoa from Peru, which is less affected by crop failures and pests than West Africa, but bean prices increased all the same.

The company doesn’t hold large warehouse stocks and typically buys beans about four months in advance. They have agreements on certain quantities and quality of beans, which they then buy at spot prices.

“That really makes us sweat these days,” said Jessica Herschkowitz, a company spokesperson.

Yet it’s not just bottom lines at risk from pricey beans – the companies’ very identities are under threat, as well.

Chocolates labeled Swiss-made must meet certain government standards for locally sourced ingredients — including milk and sugar — and be produced to a significant extent domestically, where wages are typically higher than abroad.

Famously, Toblerone, owned by Mondelez International Inc., decided otherwise and gave up its Matterhorn branding for cheaper production in Slovakia. Chocoladefabriken Lindt & Sprungli AG and Nestle SA only label some of their products as Swiss after moving large parts of their production elsewhere.

Camille Bloch, which started filling bars with hazelnut cream to survive World War II rationing of beans, continues evaluating whether production can stay profitable under those government guidelines.

“The costs for the Swiss cross must stay within reasonable limits,” Herschkowitz said.