Financial leverage to improve for Japan’s top-100 corporates

Aggregate financial leverage for Japan’s top-100 listed non-financial corporates by market capitalisation is expected to fall over the financial years ending March 2023 and March 2024 (FY23-FY24), says Fitch Ratings.

Higher EBITDA generation will more than offset increases in capex and dividends as corporates recover from the effects of the Covid-19 pandemic.

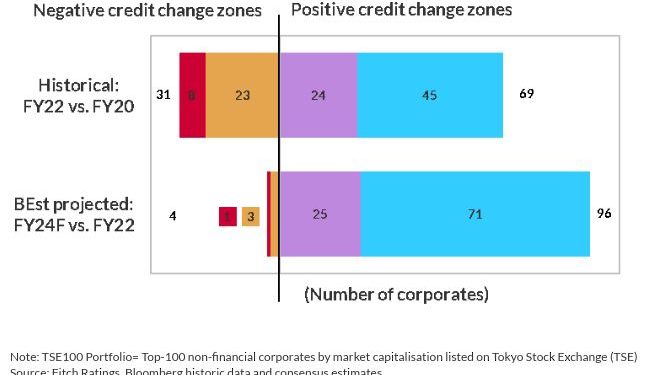

Some 96 of Japan’s top-100 corporates are projected to be in positive credit change zones, where EBITDA growth exceeds any increase in net debt over FY22-FY24, based on Bloomberg consensus estimates (BEst).

Nippon Steel, ENEOS Holdings, Toshiba and Sekisui House are the only corporates projected in the negative credit change zones. Nippon Steel and Eneos are net importers adversely affected by the weaker yen, increased commodity prices and an inability to transfer higher costs to end-customers.

Toshiba and Sekisui House are re-leveraging from a net cash position in FY21 and increasing capex and shareholder returns, while maintaining low leverage.

BEst project that the 100 corporates will realise positive free cash flow generation of JPY32 trillion over FY23-FY24, a significant turnaround from negative JPY9 trillion over FY21-FY22. Consequently, aggregate net debt/EBITDA leverage over FY22-FY24 is projected to fall by 0.75 turns to 1.3x.

With the exception of the real estate & construction sector, all sectors are expected to generate positive free cash flow over FY23-FY24, with the largest absolute gains being registered by the auto and technology sectors.

The 100 Japanese corporates were able to offset slower revenue growth in FY21, amid pandemic-related disruption, with a strong rebound in FY22 and stable to rising EBITDA margins over FY20-FY22. The transportation, energy & utilities and auto sectors all experienced revenue decline in FY21, but returned to growth in FY22.