How Congo pushed millions in additional taxes on foreign mobile operators

One afternoon in December 2021, the regional heads of four of the biggest telecom operators in Africa were summoned to the Palais de la Nation, a presidential mansion overlooking the river in the Democratic Republic of Congo’s capital of Kinshasa.

When the meeting began, officials from President Felix Tshisekedi’s administration started grilling the executives, mostly foreign nationals who represented Vodafone, Orange, Airtel and Africell, according to people in attendance. The bureaucrats informed them that the government was preparing strict new rules that would raise their companies’ tax bills significantly.

As the CEOs began to protest, a White man with dark hair who had been silently sitting in the back of the room broke in to tell them that they’d better comply, the people said. This was Philippe Heilmann, a Belgian national and the head of the Congolese offshoot of a Swiss consulting firm that describes itself as a “technology-driven company that provides digital-enabled solutions to public and private organizations.”

The firm, 5C Energy RDC, had previously partnered with the Tshisekedi administration on tax matters. More than a year before, it had worked with the government on a strategy to raise taxes on those very same telecom operators. Under that plan, which went into effect in September 2020, companies were presented with additional mobile service costs — which they then passed on to consumers. 5C Energy RDC, in turn, invoiced the state telecommunications regulator for part of the proceeds collected from the telecoms, according to documents seen by Bloomberg.

Now, the prospect of another tax increase seemed to be looming, and this time, tensions would escalate quickly. Within months of the meeting at the presidential mansion, all four of the telecom CEOs would find themselves in a high-stakes standoff with the government; their passports confiscated and operating licenses imperiled.

While the tax raise hinted at that day in December 2021 never came to pass, the companies and government did ultimately strike a different deal. Under it, the telecoms agreed to collectively pay an additional $5.8 million a month to the telecoms regulator through 2030, according to documents seen by Bloomberg. This arrangement, which is still in place, has not been previously reported on.

For this story, Bloomberg interviewed six individuals with direct knowledge of the interactions and sector-specific taxes in question, the internal workings of Congo’s government and its dealings with the phone companies and 5C Energy RDC. The people asked not to be identified out of concern for their livelihoods and safety. Congo’s telecommunications regulator, telecommunications minister, and government officials did not respond to multiple attempts to contact them. 5C Energy — which later changed its name to Veltio Consulting SA — Heilmann and the president’s office did not respond to repeated requests for comment. Representatives for Orange, Vodacom, Airtel and Africell also declined to comment on the tax dispute, 5C Energy RDC, or the business climate in Congo.

Bloomberg reached out to Veltio and to two of its Switzerland-based directors with a list of detailed questions but did not receive a response. When reached for comment, a spokesperson for 5C Energy RDC said the firm in Congo had been shut down, but did not provide further details.

The matter of telecommunications taxes might seem niche, but in the case of Congo, the stakes are enormous. With a population of around 100 million, the country is among the world’s least connected in terms of broadband internet access, and millions are locked out of the formal economy. Closing this gap could unlock billions — both for Congo’s economy as well as for its telecommunications providers.

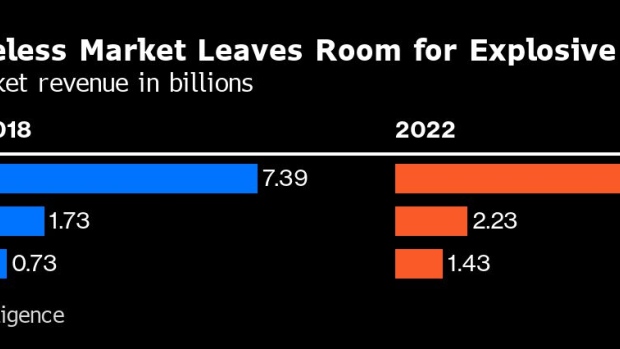

According to a report by the lobbying group GSMA, mobile technologies and services generated 8.1% of GDP across sub-Saharan Africa in 2022, creating roughly $170 billion in value. For wireless companies such as Africell, Vodacom, Airtel and Orange, Congo is the next big market. Kenya and South Africa, for instance, have populations about half the size of Congo, and their annual smartphone market revenues were $2.2 billion and $9 billion in 2022. Congo’s, by comparison, was only $1.4 billion.

Telecom Taxes

Congo’s government has for years accused telecommunication companies, which are among the largest multinationals in Africa, of hiding earnings and dodging taxes — allegations the companies strongly deny. Vodacom, officials like to point out, has never declared a profit after nearly two decades operating in the country, seemingly implying that the company is avoiding the additional taxes it would pay on profits. “I ask the question, is it normal that for more than 15 years a telecoms company can make losses?” Anthony Nkinzo Kamole, the Managing Director of Congo’s National Investment Promotion Agency, said to Bloomberg.

Russel Eastaugh, an expert on African tax laws at the Regan van Rooy firm, observed that it’s common for African governments to target foreign-owned phone companies with additional tax bills. Because the sector’s steady cash flow makes operators relatively easy to tax, the International Monetary Fund noted in a recent working paper, governments in developing countries often rely on them to supplement their budgets. But in Congo, where the average tax rate for the telecommunications sector is 34% — eight percent higher than the norm in sub-Saharan Africa, according to GSMA’s latest mobile taxation report — this practice has been taken to new extremes.

Eastaugh said that although the predicament that the operators in Congo found themselves in isn’t rare, the way it unfolded was. “Usually with these types of situations in Africa, everyone heads off to court or into negotiations of some sort and a more reasonable settlement is reached,” he said. Congo’s telecoms sector, however, has little precedent for this kind of process.

According to corporate filings, 5C Energy was founded in Switzerland in early 2016, and 5C Energy RDC was set up in Kinshasa 18 months later. Heilmann joined the latter firm in November 2019, several weeks after its founding. On archived versions of its website, 5C Energy, which changed its name to Veltio Consulting SA after it stopped working in Congo, listed TotalEnergies, Shell and Perenco as among its early clients. Two of the companies contacted said they did not have any record of having worked with 5C Energy, and the third did not respond to a request for comment.

With the exception of brief mentions in Congolese media, Heilmann, who represented 5C Energy RDC that day in the palace, has almost no online presence. His name is not registered on any major social media platforms, and he hasn’t been written about in the international press. Multiple voice, text and WhatsApp messages sent over several months to a Congolese number provided for Heilmann by somebody close to the Tshisekedi administration were never answered, nor were multiple messages left with numbers connected to another businesses registered under his name, Dreams of Africa. Filings for that company and for 5C Energy, however, do show that Heilmann established an import-export business for diamonds in 2008, which fits with one of the few biographical details about him available online: that his family co-founded the Antwerp Diamond Bourse, the world’s first exchange dedicated to uncut diamonds, many of which were sourced from Congo.

Frozen Accounts

The incident at the Palais de la Nation was not 5C Energy’s first foray into helping African governments reshape their tax regimes. According to several local newspaper reports, 5C Energy struck deals with a number of local governing bodies in Gambia several years earlier to implement and collect taxes in exchange for a large cut of the revenue. It’s unclear how much money 5C Energy collected in Gambia, but the scope of their work and the way these contracts were awarded is currently the subject of a local government inquiry.

In Congo, 5C Energy RDC’s first collaboration with the government resulted in a tax plan that passed an additional $1.17 per month for smart mobile phone services along to consumers — a significant amount in a country where average income is $1.90 a day. The hike was implemented in September 2020 and retracted in March 2022 after protests against it broke out on the streets of Kinshasa. While it was in place, however, the consultant billed Congo’s telecommunications regulator for a chunk of the profits. In November 2020, according to a leaked invoice to the regulator seen by Bloomberg, the firm claimed 30% of that month’s tax revenue, about $80,000. Bloomberg has not been able to confirm whether the government paid the invoice.

After the palace meeting in December 2021, the company heads were presented with a new tax framework, which they rejected out of hand, according to sources. Under the proposal, “discounted bundles” of data and minutes would in many cases incur taxes higher than the sticker prices of the bundles themselves, according to sources who have seen the documents. One calculation showed that a $5 bundle of minutes, SMS and data would have incurred as much as $12 in operator taxes. The proposal also prohibited operators from raising consumer prices, a move telecoms legal expert Michel Takombe believes was likely intended to prevent another public backlash.

When they refused to agree to the proposal, executives were met with intimidation and coercion, said people familiar. The companies were threatened with penalties and the prospect of having their licenses revoked. Then, in August 2022, the four CEOs had their travel documents confiscated by government officials, according to sources with direct knowledge of the situation. Unable to leave the country, one missed a child’s graduation, and another with a serious illness was prevented from travelling overseas for specialist care.

The wireless companies did not speak out publicly, and pressure on them continued to mount. In December, Vodacom’s offices in Kinshasa were sealed by agents of Congo’s General Directorate of Taxes, according to sources with firsthand knowledge. Government officials also froze the company’s local bank accounts, citing a separate $243 million tax dispute. These incidents were reported to US, UK and South African government officials, according to people who filed the complaints, but the Tshisekedi administration never changed course. The embassies of these countries did not respond to requests for comment.

Eventually, the CEOs sat down to negotiate. In lieu of the tax hike, they officially agreed to pay the government an additional $585 million in fees through 2030, with monthly payments of about $5.8 million split among the four companies on the basis of market-share, according to documents seen by Bloomberg. There is no evidence to suggest that 5C Energy RDC was involved in this aspect of the negotiations. Payments began towards the end of 2022, according to sources and documentation. Between existing taxes and these extra fees, foreign wireless operators in Congo now give about 50% of their local revenue to the government, according to sources familiar with company dealings.

International Help

It has been a little over a year since the companies and the Tshisekedi administration reached their formal agreement. Operators are now directly paying the telecoms regulator over $70 million a year — money that would have gone towards building up the country’s much-needed telecommunications infrastructure, said the people familiar. One of the operators also delayed rolling out its services into a new Congolese province as a result of the fees, they said. While the fees aren’t being passed on to consumers, they are eating into revenues and reducing companies’ ability to grow and invest, the people said.

The companies have since turned to international bodies for help. They are all in discussions with diplomats on the matter, and ministers from several foreign governments have raised the issue with their Congolese counterparts, said the people. South Africa’s government, speaking in defense of Vodacom, recently condemned the situation.

Takombe, the telecoms legal expert, believes that Tshisekedi’s reelection in December might change the government’s relationship to foreign wireless companies. Takombe described how in an interview with Top Congo, a local radio station, the president said he had not been aware of the tax standoff with wireless companies during his campaign, and that he put a stop to it once he learned what was going on. “That is an indicator that there might be a change, or more support, from the presidency for the telecoms sector and also to remove obstacles to deploy more infrastructure,” Takombe said.

It’s not clear if Tshisekedi plans to go any further. He has not introduced any additional telecommunications legislation. Tax rates for wireless operators remain the same. And as of early March, the website for Congo’s telecommunications ministry was offline.