Optimism of reducing fiscal deficit from 11.4% to 5% by 2024 not possible – Seth Terkper

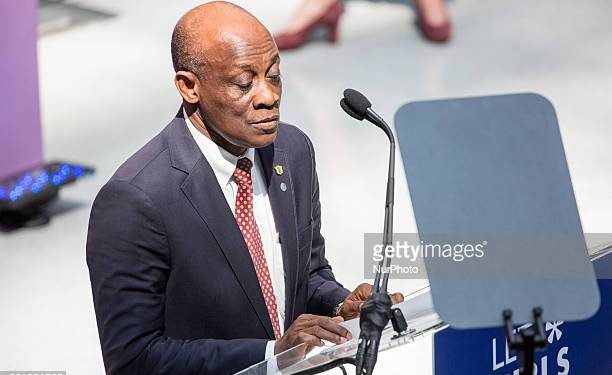

Erstwhile Minister for Finance, Seth Terkper, has said the optimism of the incumbent in achieving a fiscal deficit of 5 percent as demanded by the Fiscal Responsibility Act of 2018 is likely not to be realised.

According to the former Minister, the inability of the government to attain the target fiscal deficit is evidenced by its inability to meet its 2021 mid-year targets.

The former Finance Minister and Executive Director of PFM Tax Africa Network, in an earlier press briefing noted government’s decision to maintain its macroeconomic targets makes the country’s fiscal situation more worrisome given its continuous higher expenditures and deficits as well as stagnant revenues.

Adding that the country’s fiscal outturns in the mid-year budget review – revenues, expenditures, bailout costs, and overall deficit – diverge from the IMF’s forecasts in the July 2021 Article IV Consultation Paper.

Making the assertion at the Cedi Conference Centre at the University of Ghana (UG) on a forum dubbed State of the Economy and organised by the National Democratic Congress (NDC), Mr Terkper noted the country’s fiscal deficit will continue to widen given government’s inability to even finance two of its biggest expenditure items – consumption and interest payments.

Adding that government among other things borrows to finance arrears, previous loans contracted, operations of its agencies, current and capital expenditures etc.

The former Minister however, gave the caveat that should the government undertake some drastic measures in terms of revenue generation, it might be able to reduce fiscal deficit to the desired level in the medium term.

“The optimism that we will be reducing the deficit going into 2024 will not happen unless some drastic measures are taken. Especially when you consider the target revisions the IMF and others have made.

“The issue we have now in Ghana is that revenue is not covering expenditure, total revenue including grants and oil money and everything is unable to pay for compensation and interest payments, the two biggest items in the budget.

Read Also: Societe Generale Ghana posts 51.5% YTD return on local bourse

“And what it means is that we are borrowing to pay fully the two items, borrowing to run government agencies, current and capital expenditures, arrears and previous loans contracted.

“If we keep borrowing for all that I have listed, then it means the interest payments will go up and that will take more revenue hence the deficit will keep widening unless some drastic measures are taken,” he stated.

Meanwhile, the Minister for Finance, Ken Ofori Atta, has said the government is looking to raise its tax revenues to 20 percent of GDP in the next 2-3 years in so as to be able to finance expenditure and reduce fiscal deficit.

In his view, this is possible given government’s aggressive digitalization drive to formalize the economy and increase revenue mobilization.

Ghana’s tax revenue to GDP performance in 2020 according to data released by government was 14.7 per cent, this is however, lower than the average tax revenue to GDP rate of 16 per cent on the continent.

Government in the 2021 Budget Statement has revealed plans to increase tax revenue as a proportion of GDP to 16.7 per cent this year.

Presently, Ghana’s fiscal deficit on cash basis stands at 11.4 percent of GDP, including exceptional costs, the fiscal deficit increases to a little over 15 percent of GDP.