Standard Chartered reduces NPLs from 23.5% to 12% at end-December 2022

Standard Chartered Bank at end-December 2022 reduced its non-performing loans (NPLs) ratio on a gross basis from 23.59% in the previous year (2021) to 12.04%. This decline is significant and indicates that fewer customers are defaulting on their loans. This positive development is likely a result of the bank’s proactive approach to managing its loan portfolio, which has helped it to reduce the number of bad loans on its books.

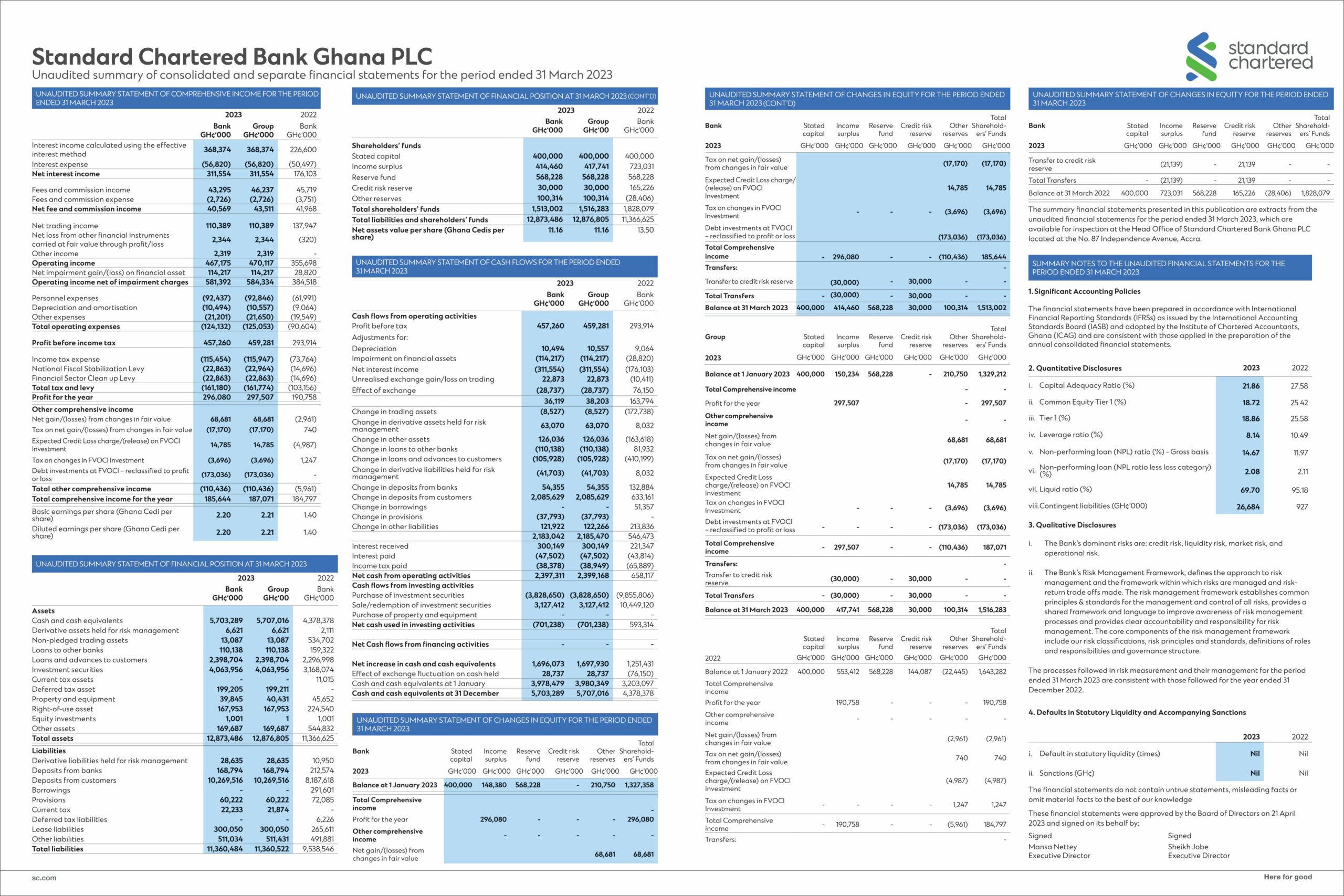

The bank’s liabilities grew from GHS 8.4bn to GHS 9.0bn within the review period, which suggests that the bank has taken on more liabilities. The bank recorded a marginal decline in its Capital Adequacy Ratio (CAR), but despite the decline, StanChart’s CAR remains strong and well above the Bank of Ghana’s minimum requirement of 10%.

Regarding profitability, Standard Chartered Bank Ghana within the review period recorded a loss of GHS 299m for the period ended December 2022, compared to a profit of GHS 436m for the same period in 2021. This decline in profitability can be attributed to the domestic debt restructuring programme undertaken by the government.

Despite this significant decline in profitability, the bank’s total assets value increased marginally, rising from GHS 10.1bn in 2021 to GHS 10.3bn in 2022. The growth can be attributed to the rise in loans and advances to customers from GHS 1.8bn in 2021 to GHS 2.0bn in 2022, indicating that the bank has been able to maintain its lending activities despite the challenging economic environment.

It is worth noting that Standard Chartered Bank is not alone in facing challenges in Ghana’s banking sector. Other banks have also reported declining profitability in recent years. This trend is a reflection of the challenging economic environment in the country, which has been marked by high inflation, a weakening currency, and a high level of government debt.

While the decline in profitability for Standard Chartered Bank in Ghana is a cause for concern, the bank’s strong CAR and declining NPLs suggest that it is well-positioned to weather the storm. However, the bank will need to continue to take proactive measures to manage its loan portfolio and improve its profitability going forward. Given the challenging economic environment in Ghana, it will be interesting to see how Standard Chartered Bank navigates the current landscape and what steps it takes to improve its performance in the coming years.